Being a Blogger, You often have to create invoices for your clients who are using your services or made sponsored posting on your blog. There are various tools available to create invoice. But what if you find an intuitive tool that helps you to create an invoice and accepts payments? isn’t it cool?

In this post, I am going to show you how to create an invoice and accept payments using FreshBooks. Some of you are quite unaware of FreshBooks. Let me first introduce it to you.

What is FreshBooks

Freshbooks is a cloud-based accountancy and online billing tool. It helps you to create invoices for your clients and advertisers and accept payments from multiple sources. This tool has empowered many small business and individuals to get paid from their invoices.

The company was founded in 2003 by Mike in his parent’s basement. Now the company has various office locations. FreshBooks have already served more than 24 million people across the globe.

Features and benefits

Freshbooks is an ideal invoicing and accountancy solutions for individuals self-employed to agency and corporates as well. It comes with many robust features that helps you to manage your invoices easily. Let’s check out some of their features:

1. Easy Invoicing

FreshBooks makes Your invoicing and billing so simple. It helps you to create professional looking invoices for your business ridiculously easy. You can also customize your invoice, add your logo and personalize your thank you email.

2. Easy Accounting

Accounting is a big challenge when your business grows. FreshBooks allows you easy accountancy with Double-Entry accounting. It identifies revenue items and their related expenses, giving you a precise calculation of profits and losses

3. Track Your Expenses

Tracking your expenses is a hefty job. FreshBooks allows you to connect your bank account to your FreshBooks account. Whenever Your Freshbooks account updated with expenses. It reflects your bank account as well. There is no need to manually enter them.

4. Accept Multiple payments

The days are gone when you are using a single payment option. Now you have to cover your business worldwide and accepting multiple payment options is an extra advantage to it. FreshBooks Payments allows your customers to pay directly through invoices and instantly records each payment in your account.

5. Easy Integration

FreshBooks allows you to integrate it with various online services like Gsuite, Shopify, Zapier, Stripe, Woocommerce, Gusto, MailChimp, etc. Seamless integration with other apps makes it more flexible.

Pricing

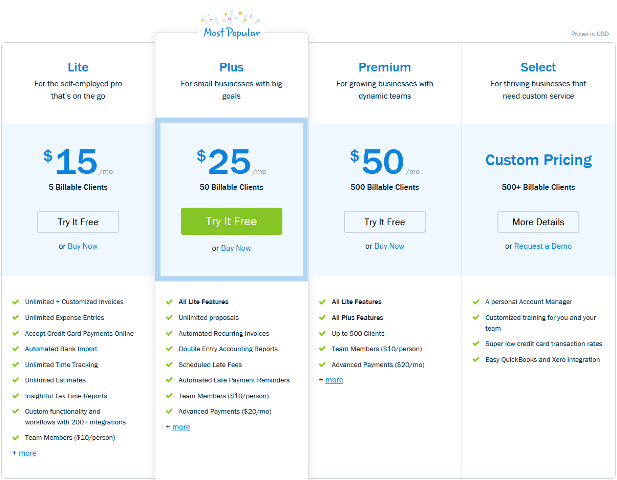

FreshBooks comes with flexible and affordable pricing options. It currently offers 4 plans. Lite, Plus, Premium, and custom

Lite plan ($15 per month) is suitable for billing up to 5 clients. You can send Unlimited invoices to your users. Accept multiple payment options and get paid directly to your bank account. Start your 30 days free Trial on all plans. No Credit Card required. You can cancel at anytime.

You can also upgrade to top plans as per your needs and requirements.

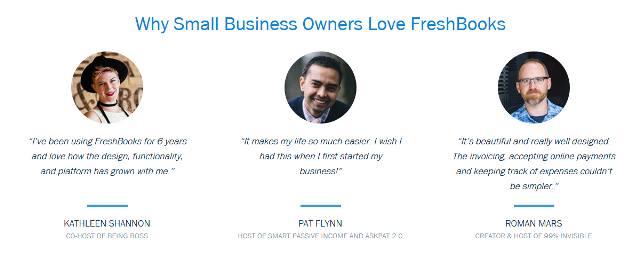

FreshBooks has been tested and trusted by many industry leaders. The easy to use and reliable features help you to keep your accountancy easy. Keep track of our all profits and loss. This revolutionary online tool helps you to skyrocket your business.

Support

FreshBooks currently offer phone, email and ticket support to its clients. They also have vast knowledge bases for the users which helps you to create and send invoices to your clients. All of your queries and questions are resolved in a timely manner.

Conclusion

Invoicing and accounting is a big headache for small business. FreshBooks allows you to streamline your accountancy and keep your business organized. Create an invoice and accept payments using FreshBooks. If you haven’t tried them out? I highly recommend you to give them a try. I hope you have liked the post, please share it.

Hi Vishwajeet!

Really very helpful and informative review as usual.

Thank you for this in-depth article about Freshbooks. Very useful since I’m looking around trying to find the best invoicing app for my small business.

Regards

Vishal Meena