Employee Provident Fund or PF as commonly known is one of the best superannuation funds for employees in India. It is created with a 12% contribution from the employee’s salary and an equal contribution from the employer. Also mandated by the government in the way of helping employees create a retirement fund. It is administered by the Employee Provident Fund Organisation (EPFO) which is governed by the Ministry of Finance. The interest rate for EPF is decided each quarter under the Small Saving Schemes Act. Currently, it stands at 8.6% post the REPO rate cuts in June 2019 by the Reserve Bank of India.

Employees need to be aware of the balance saved in their EPF accounts to be able to plan for their retirement. The EPFO has created an all-inclusive portal where you can read statements, check balance, and request transactions. You need to be aware of a few things before you can login and do a PF fund balance check . Generally, people wait for their employer to share their PF balance with the tax forms at the end of the year. However, this is not required, and once you know your UAN ( Universal Account Number) , you can login to the EPFO portal, SMS or give a missed call to various service numbers provided by the EPFO.

This UAN number is assigned to each employee once the employer opens his account to deposit the monthly contribution with the EPFO. You can get your UAN number from your employer or using the employer’s code.

Checking Balance Without UAN

However, if you do not know your UAN, you can still check your PF balance. However, your PF account should be activated, and you should have your PF account number –

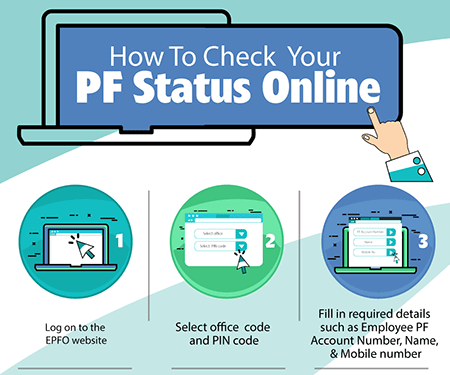

- Go to URL: https://www.epfindia.gov.in

- Search for the link which says “Click here to know your EPF balance”.

- Click, and you will be redirected to URL: http://epfoservices.in/epfo/

- You should see a button saying “Member Balance Information” Heading.

- Under this, the dropdown menu, choose your state.

- Then go ahead and choose your EPFO Office and click on your Office Link.

- You should have a linked mobile number, name, and EPF account number ready to input.

- Submit this form, and you will be able to view your PF balance.

However, please note this approach will give you limited functionality, and it is better to draw out your UAN number from your PF number and employer code. You can then login and also place requests for PF transfer or consolidation of various accounts.

Make The Best Use of PF Balance

As you keep track of your PF balance and are nearing retirement, you might start thinking about where to invest this amount. Traditional investment options like PPF and bank FDs are now offering lesser interest rate due to a recent reduction in the REPO rate and Small Savings Schemes interest rates. Moreover, these investments fail to provide positive returns when inflation is at its peak.

Company FDs are a good investment option to grow your EPF money as they offer high-interest rates as compared to bank FDs. Some of these FDs, like Bajaj Finance FD are accredited for their stability by CRISIL and ICRA. This means you have the utmost guarantee of timely repayment of your principal amount and interest.

Fixed deposits from Bajaj Finance also offer lucrative interest rates. Anyone can easily avail interest rate of 8.65% for a cumulative 3 year FD and continue to earn 8.95% if you are a senior citizen.

You can look forward to using facilities such as online FD calculator which will help you decide how much amount to deposit in one FD and for what tenor to achieve the desired maturity amount. You can also utilize a lump sum amount to create multiple FDs with one deposit. With Experia- your online fixed deposit account, it is easy to manage multiple FD accounts and ladder your investments to ensure a continuous stream of returns.